matterlogoboss

Desahogo De Vista De Contestacion De Demanda Mercantil

This is a blog about the use of emerging technologies to boost the governance of public procurement. It used to be a blog on EU law, with a focus on free movement, public procurement and competition law issues (thus the long archive of entries about those topics). I use it to publish my thoughts and to test some ideas. All comments are personal and in no way bind any of the institutions to which I am affiliated and, particularly, the University of Bristol Law School. I hope to spur discussion and look forward to your feedback and participation. The case concerned the wholesale distribution of medicinal products in Italy.

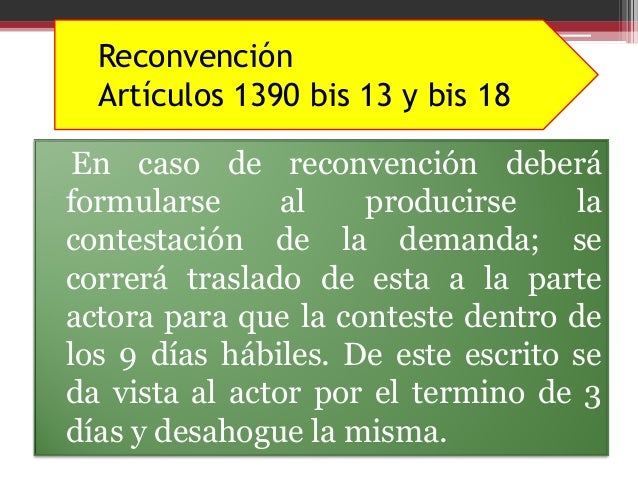

- Desahogo De Vista De Contestacion De Demanda Mercantil Ecuador

- Desahogo De Vista De Contestacion De Demanda Mercantil Pagare Vencido

Generally, wholesale distribution of such products is regulated under EU law by Directive 2001/83/EC on the Community code relating to medicinal products for human use, as amended by Commission Directive 2009/120/EC. The Directive requires wholesale distributors to obtain a special authorisation, for which certain harmonised requirements are set.

However, relevant Italian domestic legislation sets a different requirement, since it allows pharmacists and companies of pharmacists in possession of a licence to operate a pharmacy ( ie to sell medicinal products at retail level) to also operate as wholesale distributors (and that 'standard' authorisation does not impose the same requirements that the Directive sets for the 'special' wholesale authorisation). The common understanding, even by public prosecutors in the specific case, of the Italian rules on retail and wholesale authorisations was that a pharmacist already authorised to retail medicinal products was exempt from the obligation to obtain the special authorisation required under the material national and European Union rules applicable.

On its face, the argument seemed deffective (as the referring Court of Palermo implicitly indicated by requesting the CJEU to issue a preliminary ruling), and it seems rather clear that Italian law has not properly transposed Directive 2001/83/EC, since it requires no special authorisation for wholesale distribution on top of the 'standard' retail authorisation given to pharmacists. The point of interpretation of domestic law in light of the requirements of EU law was, then, to determine whether pharmacists engaging in wholesale trade on the basis of their 'standard' authorisation to distribute medicinal products at retail level were doing so unlawfully under EU rules. The issue was not minor since this could generate criminal liability, as Italian legislation also determined that any person that engages in unauthorised wholesale distribution of medicinal products was liable to punishment in the form of imprisonment for a term of six months to one year and a fine of between €10,000 and €100,000.

52 As the Court has held, the principle of interpreting national law in conformity with European Union law is limited by general principles of law which form part of the European Union legal system, in particular, the principles of legal certainty and non-retroactivity. Thus, a directive cannot, of itself and independently of a national law adopted by a Member State for its implementation, have the effect of determining or aggravating the liability in criminal law of persons who act in contravention of the provisions of that directive (see, inter alia, Case C‑60/02 X 2004 ECR I‑651, paragraph 61 and the case‑law cited). To sum up, it is submitted that (except in those cases where there is potential for criminal liability), Member States are under an almost absolute obligation to guarantee that domestic legislation is interpreted and applied in a manner that is consistent with EU law and, in particular in the case of directives, to ensure that their goals and intended effects are attained through national legislation—regardless of whether that legislation was adopted for the sake of transposing those directives, and regardless of the proper or improper transposition of those directives. In my opinion, this seems like an area of EU law where case law will continue to develop in the recent future, particularly if national courts continue to refer cases for interpretation, for instance, in relation with the ever increasing number of soft law and hybrid instruments issued by EU institutions. Even if the Caronna Judgment does not advance EU law in this field, it is a very clear reminder of the limits of consistent interpretation in cases where criminal liability is concerned, where the exercise required from national courts is much more restricted than in cases where no criminal liability is involved. The US Supreme Court has decided to hear a case that involves a potential refinement of the so-called State Action Doctrine (or Parker v.

Brown antitrust immunity), where it will analyse whether the exercise of “general corporate powers” by a subdivision of a local authority amounts to a “clearly articulated and affirmatively expressed State policy to displace competition in the market” (the FTC petition for certiorari is definitely worth reading, as it provides an excellent summary of the State Action Doctrine in the US: ). The case will have very relevant implications for the analysis of State intervention in the economy through ‘private law’ entities and instruments, and may contribute to restrict the scope of the State Action Doctrine to preserve its core elements: democratic decision-making based on an overriding public interests, clear articulation, and effective enforcement. Needless to say, the US S. Kiss beyond the makeup.

Decision in Federal Trade Commission, Petitioner v. Phoebe Putney Health System, Inc., et al. Is much awaited. This case should bring echoes to the EU position in this field, were the equivalent of the State Action Doctrine has, at best, been dormant for too long. According to the settled case law of the EU judicature, where a Member State’s legislation or regulation i) requires undertakings to conduct anti-competitive behaviour, ii) reinforces the effects of previous anti-competitive behaviour adopted by the undertakings, or iii) delegates responsibility for decisions affecting the economic activity to undertakings, the ECJ will analyse whether it frustrates the effet utile of the EU competition rules (Case 267/86 Van Eycke 1988 ECR 4769 16, which remains substantially unaltered; see Case C- 446/05 Doulamis 2008 ECR I-01377). Therefore, the Van Eycke test is much broader and lenient that the equivalent US State Action Doctrine (and light years away from its sophisticated foreseeable development) and in my opinion gives excessive room to anticompetitive public market intervention in the EU, particularly through the use of market instruments or ‘private law’ tools.

It is hard to envisage a good reason to exempt the conduct of the public sector from competition scrutiny in those cases i) where the protection derived from the legitimacy of the public competition-distorting action is feeble because the adoption of anti-competitive rules and legislation does not respond to a real political option and is not the result of a proportional trade-off between different, competing policies, or ii) where competition-distorting practices and policies are adopted as a result of ‘mere’ administrative discretion. Therefore, these activities should not be covered by the State Action antitrust exemption—as they do not seem to comply with the sovereignty and legitimacy criteria that justify the existence of the State Action Doctrine of competition law immunity. Moreover, while being imbued with a lower legitimacy level, low-level administrative practices and decisions—as opposed to legislation and regulation stricto sensu, seem to present a higher risk of generating anti-competitive effects (as they are more specific and usually complement the general criteria contained in the laws and regulations which, precisely because of that generality, will tend to be less restrictive). Consistently, they should be subjected to more intense competition scrutiny. Whereas the first part of the development of the current State Action Doctrine in relation to the adoption of anti-competitive legislation and regulations merits further analysis, developing a ‘market participant exception’ would suffice to effectively subject public administrative practices to competition law scrutiny.

That is, ‘piercing the sovereign veil’ to subject to competition scrutiny all instances of market intervention related to non-regulatory activities could contribute to fostering competition. That is, complying with sectoral rules is not an antitrust defence if, within the same regulatory framework, the undertaking could have behaved procompetitively or, at least, could have avoided a breach of the competition law provisions of the TFEU. To be sure, this case law assumes that there is a clash between competition law goals and not sectoral regulation itself, but the understanding and strategic behaviour of (dominant) undertakings subjected to regulation-and ultimately, somehow, seems to blame undertakings under the (implicit) principle of the 'special responsibility' derived from market dominance and a more general duty to 'analyse and comply with' sectoral regulation in a procompetitive manner. Per comparison, the US has a more lenient approach that tends to prevent overlaps and double enforcement of competition and sectoral rules, as long as undertakings meet the test set by the US Supreme Court decision in Credit Suisse v. Billing 127 S.Ct.

Desahogo De Vista De Contestacion De Demanda Mercantil Ecuador

2383 (2007)- which requires a sectoral watchdog to be properly working and exercising its regulatory powers, and undertakings to behave within the limits set by sectoral regulation and the watchdog's decisions. Therefore, undertakings are 'off the hook' if their (possibly more competitive) conduct has been effectively overseen and approved by the sectoral watchdog. Under the US approach, it seems clear that, in a simplified manner, competition law should be adjusted (ie, reduced) when its application in regulated sectors could defeat the purpose and objectives of sectoral regulation (particularly, because it would impose a second check on market activities that were mandated by the sectoral regulator, diminishing legal certainty due to a potential squeeze between ex ante regulatory tools and ex post competition enforcement). If this is the case, then it may even be necessary to go so far as to refrain from applying competition law at all in regulated industries if the allegedly anti-competitive practices have been the object of specific regulation and effective supervision by the sectoral agency. But only in those cases.

Moreover, price-fixing cartels are at the core of competition law prohibitions and fully in line with sectoral regulation, which cannot and does not require price-fixing agremeents (but, on the contrary, tends to promote competition by bridging gaps left by potential insufficiencies of 'natural' competitive pressure). Therefore, there is no potential clash between the goals of sectoral regulation and 'general' antitrust rules-and, consequently, no apparent spill-over or unintented consequences derived from the joint enforcement of both sets of rules. The only concern that may be left to consider is the aggregate amount of the fines finally imposed, in order to deter overdeterrence and to avoid jeopardising the viability of entities already in a difficult financial situation (so that competition law fines do not require bail outs, for instance). In that regard, competition authorities (the European Commission, OFT, or others within the ECN) should probably take into consideration the fines already paid to the financial supervision agencies, in order to adjust the level of the competition fines they intend to impose on the banks. In its Judgment of 19 June 2012 in case C-307/10 Chartered Institute of Patent Attorneys v Registrar of Trade Marks, the Court of Justice of the EU has stressed a principle in EU trade mark law that does not lose relevance despite being rather obvious: ' the Trade Mark Directive 2008/95/EC of 22 October 2008, OJ 2008 L 299, p. 25 must be interpreted as meaning that it requires the goods and services for which the protection of the trade mark is sought to be identified by the applicant with sufficient clarity and precision to enable the competent authorities and economic operators, on that basis alone, to determine the extent of the protection sought' (see press release: ).

Desahogo De Vista De Contestacion De Demanda Mercantil Pagare Vencido

In line of principle, the finding does not seem to develop EU trade mark law substantially. However, in my view, the CIPA Judgment flags up the need to revise, or at least fine-tune, the Nice Agreement Concerning the International Classification of Goods and Services for the Purposes of the Registration of Marks concluded at the Nice Diplomatic Conference on 15 June 1957, last revised in Geneva on 13 May 1977 and amended on 28 September 1979 (United Nations Treaty Series, Vol. 1154, No I 18200, p. 89), since its structure and common use may be insufficient to guarantee compliance with the required standard of 'sufficient clarity and precision to determine the extent of the protection sought'. In the case at hand, the Registrar of Trade Marks had refused an application by the Chartered Institute of Patent Attorneys (CIPA) for the registration of the designation ‘IP TRANSLATOR’ as a UK national trade mark.

To identify the services covered by that registration CIPA used the general terms of the heading of a class of the Nice Classification: ‘Education; providing of training; entertainment; sporting and cultural activities’. Even if they are not mentioned in the class heading, other services such as translation services are grouped under the same class in the Nice Classificiation. Hence, the basic question in the CIPA case revolved around whether the application included translation services or not-since, in the view of the Registrar of Trade Marks, for these latter services the designation 'IP TRANSLATOR' lacked distinctive character and was descriptive in nature.

The CJEU has determined that the Trade Mark Directive does not preclude the use of the general indications of the class headings of the Nice Classification to identify the goods and services for which the protection of the trade mark is sought. But the CJEU has also found that recourse to the general headings in the Nice Classification is not always enough to meet the 'sufficient clarity and precision' requirement, since some of the general indications in its class headings are too general and cover goods or services which are too varied to be compatible with the trade mark’s function as an indication of origin. Therefore, the CIPA Judgment raises an issue on whether the Nice Classification is apt to serve its intended function or, as it seems, requires a revision (after more than thirty years since the last one). The CJEU has clearly placed the burden of overcoming those imprecisions of the Nice Classification on applicants, since ' an applicant for a national trade mark who uses all the general indications of a particular class heading of the Nice Classification to identify the goods or services for which the protection of the trade mark is sought must specify whether its application for registration is intended to cover all the goods or services included in the alphabetical list of that class or only some of those goods or services.

If the application concerns only some of those goods or services, the applicant is required to specify which of the goods or services in that class are intended to be covered'. (97) While a Member State may act as a shareholder in addition to exercising its powers as a public authority, it must not combine its role as a State wielding public power with that of a shareholder. Allowing Member States to use their prerogatives as public authorities for the benefit of their investments in enterprises operating in markets that are open to competition would render the Community rules on State aid completely ineffective.'

(Decision 2005/145/EC of 16 December 2003 on the State aid granted by France to EDF). Basically, the Commission opposed the possibility to conduct a global appraisal of the conversion into capital of a tax claim by the State under the 'market economy private investor test' on the basis that a private investor could never hold a tax claim against an undertaking, but only a civil or commercial claim. Therefore, the Commission contended that tax measures that directly imply a capital injection (because the taxes not levied are added to the net assets of the beneficiary company) cannot be analysed as a whole and, if appropriate, be allowed as a single transaction. But that, rather, Member States should exact taxes from undertakings in regular form, and then inject the same amount of capital as State aid (in a double circulation of capital, rather than a set-off or compensation), if they wanted to benefit from an appraisal of such capital injections under the 'market economy private investor test'. '. contrary to the assertions made by the Commission and the EFTA Surveillance Authority, the private investor test is not an exception which applies only if a Member State so requests, in situations characterised by all the constituent elements of State aid incompatible with the common market, as laid down in Article 107(1) TFEU.

where it is applicable, that test is among the factors which the Commission is required to take into account for the purposes of establishing the existence of such aid.' (ECJ C-124/10 P, at para. 103, emphasis added).